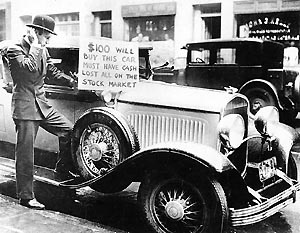

This article by Steve Denning on Forbes.com really hit me. Much of it cites Joe Stiglitz, a Nobel Prize winning economist who has an article in Vanity Fair that argues our current economic downturn isn’t just a cyclical dip, but the mark of a significant phase-shift in our economy, similar to the phase-shift that happened around the Great Depression. I am normally one to be skeptical at “this may be the big one” arguments, but the whole Nobel prize thing kept me reading.

This article by Steve Denning on Forbes.com really hit me. Much of it cites Joe Stiglitz, a Nobel Prize winning economist who has an article in Vanity Fair that argues our current economic downturn isn’t just a cyclical dip, but the mark of a significant phase-shift in our economy, similar to the phase-shift that happened around the Great Depression. I am normally one to be skeptical at “this may be the big one” arguments, but the whole Nobel prize thing kept me reading.

And he certainly makes a compelling case. I am not a saavy investor who got in to buy Apple shares UK at the right time. I was kind of embarrassed to face the fact that my understanding of the Great Depression boiled down to random ideas and phrases like “stock market crash,” “dust bowl,” and “new deal.” My analysis: it was really bad and World War 2 (and the manufacturing economy spurred by the war) got us out of it. You’d think after all my education you’d get a more nuanced understanding. No matter. Now I can just point to the article. 🙂

Stiglitz pointed out that the depression was a result of a huge shift in our economy, from agriculture to manufacturing. We HAD to have that depression to deal with the fact that our large portion of our workforce was focused on doing something (farming) that wasn’t going to make money and be sustainable like it used to be. We needed to shift into a phase where farming was much smaller and manufacturing was much bigger. You don’t do that by retraining people over a two year period. You need a structural adjustment. Stiglitz argues that the banks failing, etc. was a RESULT of this shift, not a CAUSE of the depression.

So today we might be in a similar boat. This is the time where we finally have to shift AWAY from the manufacturing economy. Stiglitz says it will be towards a service economy, but Denning suggests it will actually be a “creative” economy.

The Creative Economy is one in which both manufacturing and services play a role. It is an economy in which the driving force is innovation. It is an economy in which organizations are nimble and agile and continually offering new value to customers and delivering it sooner. The Creative Economy is an economy in which firms focus not on short-term financial returns but rather on creating long-term customer value based on trust.

Innovation, nimble, continually offering new value, trust…sound familiar? This is what we talk about in Humanize. We hadn’t thought about it in terms of preparing companies for an entirely new economy, but hey, if that what it takes, we’re game! Denning talks about that:

Most large firms of today are ill-equipped to compete in the emerging Creative Economy, in which globalization and the shift in power in the marketplace from seller to buyer have put the customer in charge. Most big firms still have a factory mindset oriented to economies of scale. They are focused principally on maximizing short-term shareholder value. They are not organized for continuous innovation. This way of managing is unable to mobilize the full creative talents of their employees.

Or their customers. I know it’s hard to believe, given the collective accomplishments of all the large companies in today’s economy, but the power of our existing approach is in decline. And if we really are in an economy-phase-shift, then the rate of decline is only going to increase.

So let’s get started now. Let’s start creating organizations that are more open, trustworthy, generative, and courageous. Let’s not wait for it to get worse. Let’s not wait until we can see a quantitative research study that shows a statistically significant increase in performance in “humanized” organizations before we start to take action. Let’s not wait for best practices.

Let’s start a movement.

How I understood the book Freefall from Joseph Stiglitz was the concept of the crisis was unnecessary and it was a consequence of a market liberalization, especially the banking sector.

During that time, banking sector moved from the “hard” lending (to expand or create new businesses and from creating more work in general) to the “soft” lending, in which the main cash flows were directed to individual loans, mainly mortgages.

The result was clear. The bubble was growing while with more loans into unproductive sector, there was not enough jobs created in the economy, which led to faster growth of prices than real salaries. In the end, when this system collapsed, it was bailed out by the US government (by using the clear formulaPrivatizing Profits, Socializing Losses).

Moving towards so called productive economy would need more incentives from the part of the government, which I do not see as a real possibility in this decade. The craziness about austerity is going to move all western capitalist economies further on the downward spiral.

A good topic to raise – hugely important.

Stiglitz makes some good points, but they’re aren’t exactly the whole picture.

^ The Depression of the 1930’s was partly due to a shift in economic structure – but the biggest influence was the collapse of capital markets, resulting from the manufacture of paper money and investments by banks into poor markets.

^ WW II didn’t pull us of of the depression as much as shifts of capital into better investments – and those investments did create more jobs. It was from this improved industrial base, coupled with FDR’s command to industrial leaders, that enabled the infrastructure to build war equipment, etc.

Are we in a shift from manufacturing to digital economies. Yes

But I do agree with Stiglitz that the Depression today will go on for another decade or so.

Why? Two primary reasons imo:

1. We have huge surpluses of Capital sitting next to huge surpluses of Labor. So capital is heavily invested in paper tigers, while labor continues to lose value – years of unemployment will do that.

2. Technological leaps are creating knowledge gaps at too fast a rate. It used to be that new technologies would displace workers, but result in improved productivity and stronger economies. But there was enough time for workers to catch-up and re-tool their skills. Now, that’s become much harder. So although we’ll see productivity gains from technological innovation, we’ll see economic losses from growing mass unemployment.

Companies do need to humanize for sure. But they’ll also need to be mindful of the external costs of over-using technology.

That’s a hard thing for them to do when the prospect of better returns on equity face them.

The US economy in particular has a lot of work cut out for itself.